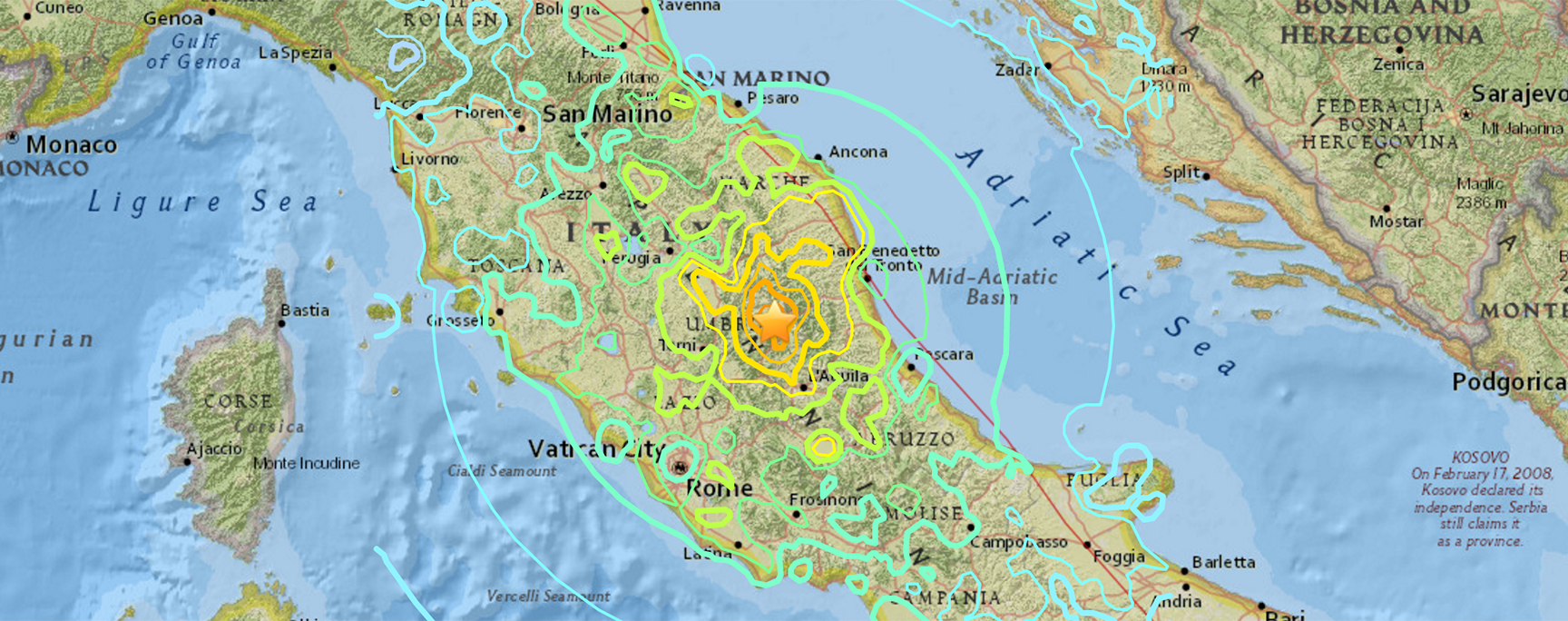

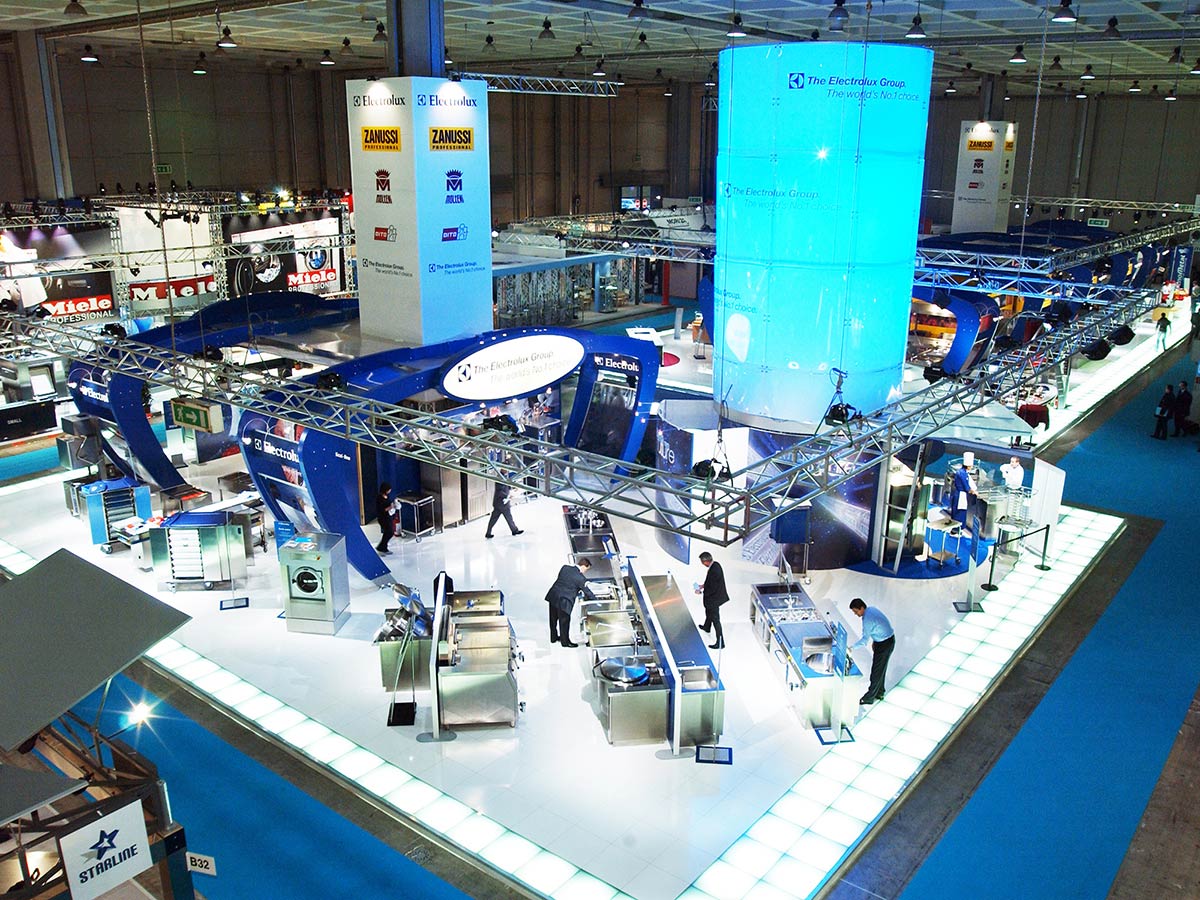

Italy’s InvestorVisa program offers unique investment and donation opportunities in Italy for non-EU citizens.

By investing in an Italian business, making a donation to a cultural institution, or contributing to a civic betterment program, non-EU citizens can obtain work visas and resident status.

CLICK HERE TO DOWNLOAD the InvestorVisa catalog,

including donation opportunities for foreigners.

CLICK HERE TO VISIT THE InvestorVisa WEBSITE.

The new entry visa (Article 26-bis Consolidated Law on Immigration) offers many advantages:

• The holder shall receive an entry visa and a residence permit valid for 2 years. Once expired, the permit is renewable for the next three years. After five years the foreigner resident can apply for a long-term residence permit.

• The opportunity to stay in Italy or run your business from your country without waiting for further permits or visas. It is also possible to enter other EU countries (Schengen Area) and stay up to 90 days every six months.

• The family members of investor visa/permit holders can also apply for a residence permit for family reasons. Subjects eligible for this permit are:

– spouse or partner, not legally separated and over 18. With this residence permit, he/she will be allowed to work or study in Italy at any level, likewise Italian citizens;

– underage unmarried children, included adopted children. They will be allowed to work or study in Italy same as Italian citizens do;

– the adult unmarried children of the investor or his/her spouse, where they are objectively unable to provide for their own needs on account of their state of health;

– first-degree relatives in the direct ascending line of the investor or his/her spouse, where they are dependent on them and there are no other children in the country of origin;

– first-degree over 65 relatives in the direct ascending line of the investor or his/her spouse, when there are no other sons able to take charge of their care due to certified health reasons.

• If interested in moving the fiscal residence to Italy, the investor could get a forfeit tax on the income earned abroad.